Member Loyalty Cash is not your average loyalty program. Members who qualify earn cold, hard cash at the end of the year!

We want to thank you for being an active member-owner and taking advantage of our products and services. Your loyalty directly contributes to the economic success of our shared, not-for-profit financial cooperative.

{beginAccordion}

About the Program

{openTab}

As a credit union, FCCU operates based on the needs and wants of you, our member-owners, in the form of a democratically-elected volunteer board of directors.

This not-for-profit cooperative business structure allows us to put a primary focus on products and services that benefit individual members. In contrast, other financial institutions are primarily profit-driven, which may not always benefit individual customers because they do not have a say in what is done with those profits— only its shareholders do.

In 2015, our board of directors established a new patronage dividend program, Member Loyalty Cash, to encourage member economic participation (one of our 8 cooperative principles) and reward more members for taking advantage of our products and services.

On January 1, 2016, the first Member Loyalty Cash payout reached 24% of members receiving at least $17.00— which far exceeded past patronage dividends that reached a much smaller percentage of members for a substantially lower amount on average.

2024 Member Loyalty Cash Payout

$400,000

distributed to members

38%

of members qualified

$2.85 million

distributed since 2015

{endAccordion}

{beginAccordion}

How to Qualify

{openTab}

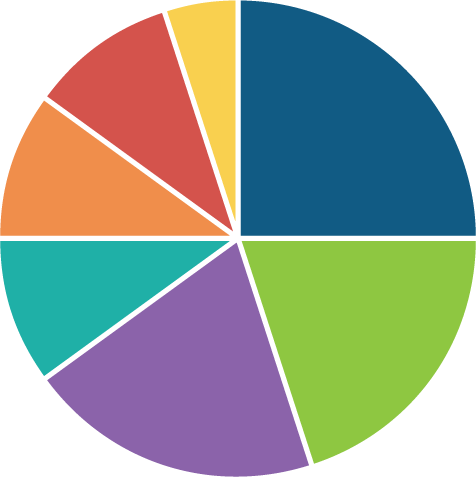

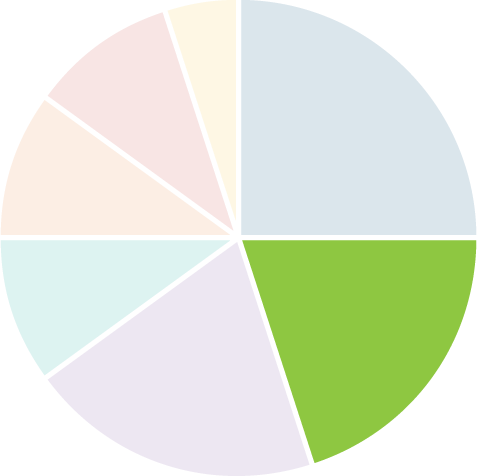

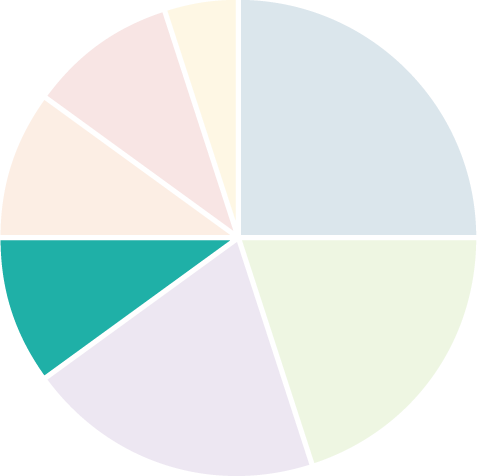

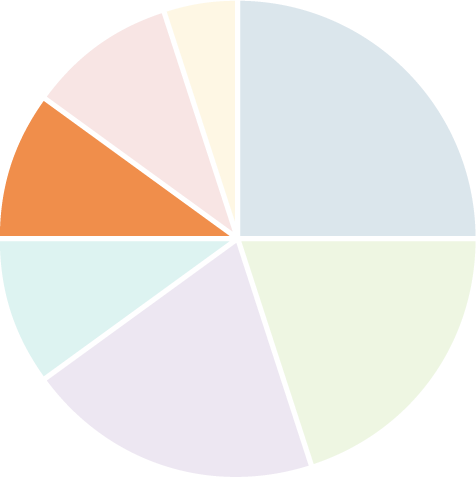

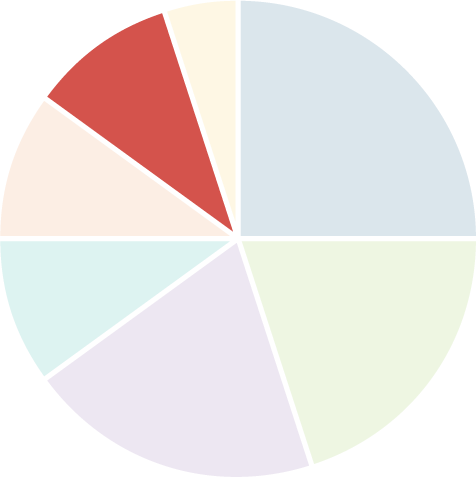

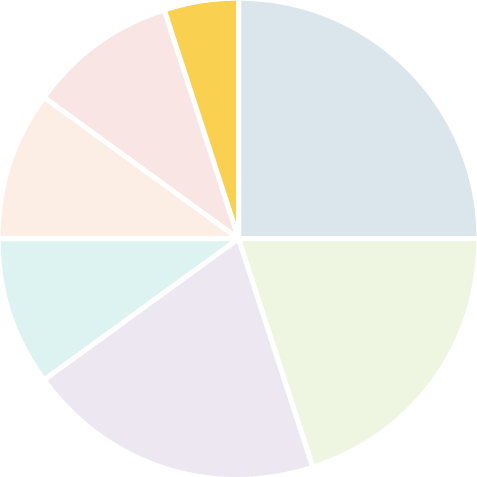

To qualify for the Member Loyalty Cash payout at the end of the year, use any combination of FCCU products and services, adding up to 50%.

Once you reach 50%, any additional products and services will increase your total payout!

25% Debit Card

Member has an active debit card with an average of 10 point-of-sale transactions per month and card open at year-end.

20% Loan

Member has a loan balance1 with FCCU. All loans must be current and cannot be delinquent twice throughout the current year.

20% Deposits

Member has a minimum average total balance of $2,000 in their deposit accounts. Total balance considers all account suffixes.

10% Credit Card

Member has an active2 credit card.

10% E-Statements

Member is enrolled in e-statements.

Member is an active3 user of either online or mobile banking.

Member has a checking account with a debit card.

[1] Mortgage loans must originate in the current year. Student and non-member commercial loans are not eligible for this portion.

[2] Active is a charge or payment transaction within the last 30 days of year-end.

[3] Active is a login within 30 days of year-end.

{endAccordion}

{beginAccordion}

Frequently Asked Questions

{openTab}

When is Member Loyalty Cash disbursed?

Members who qualify for Member Loyalty Cash will see a deposit in their account on the last day of the calendar year.

Why did one of my accounts receive Member Loyalty Cash but not the other?

Each member number will qualify and potentially receive Member Loyalty Cash independent from other member numbers. That means if you have two separate accounts (e.g. 12345-6 and 12345-7), each account must qualify before receiving payout. Member Loyalty Cash will be deposited in your lowest savings account suffix.

How is the amount of the Member Loyalty Cash deposits determined?

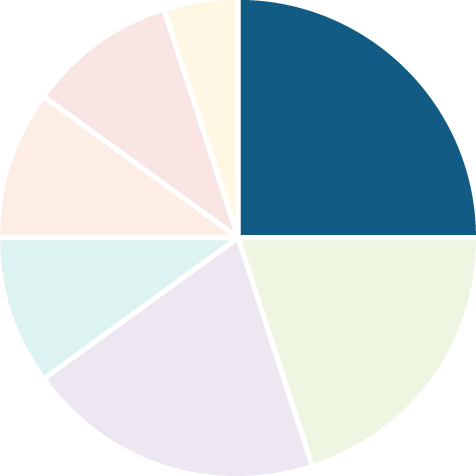

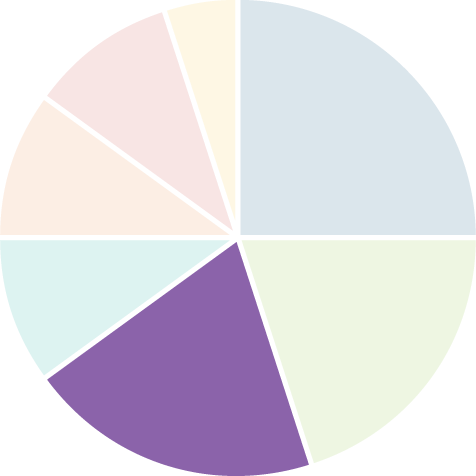

FCCU's volunteer, elected board of directors determines the total disbursement amount based on the year's profits. The total disbursement amount is then divided up between the different percentage categories (e.g. 50%, 55%, 60%, etc.).

Since FCCU is a not-for-profit financial cooperative, Member Loyalty Cash is one way we give our profits back to our member-owners.

What do I do if I have more questions about Member Loyalty Cash?

Give us a call at (920) 563-7305 or email memberservices@fortcommunity.com, and we would be happy to assist you!

{endAccordion}