Looking to buy a home and don't know where to start? You've come to the right place!

Skip to a Section

{beginAccordion}

First Steps

{openTab}

Get a Free Copy of Your Credit Report

Credit Report - A record of an individual's current and past debt repayment patterns. A credit history helps a lender to determine whether a borrower has a history of repaying debts in a timely manner.

Review your credit report for accuracy and file a dispute if you notice any errors:

- Credit Score & More - Access a suite of free credit monitoring tools (including your credit score and credit report) directly in online & mobile banking.

- AnnualCreditReport.com - You have the right to request one free copy of your credit report each year from each of the three major consumer reporting companies. See frequently asked questions on the Consumer Financial Protection Bureau website.

Each loan program will have unique credit requirements. In general, lenders are looking for a minimum credit score of 620. The closer your credit score is to 850, the better interest rate you'll receive.

Need help building credit or want 1:1 financial advice? Meet with an FCCU Financial Coach or GreenPath Professional Counselor to create a plan towards homeownership!

Determine Your Ideal Mortgage Payment

Mortgage Payment - The minimum amount you pay on your mortgage loan every month for the life of the loan.

Determine Your Ideal Down Payment

Down Payment - The portion of the home's purchase price that you will pay up front (by check at closing) rather than borrowing.

The standard down payment is 20% of the home's purchase price, though you may qualify for down payment programs that will allow you to put down less.

Get Prequalified

Prequalification - Procedure to determine how much money a potential homebuyer will be eligible to borrow prior to actually applying for a loan.

{endAccordion}

{beginAccordion}

Application & Processing

{openTab}

10 Commandments When Applying for a Mortgage

Thou shall not...

- change jobs, become self-employed, or quit your job

- buy a car, truck, or van

- use credit cards excessively or let current accounts fall behind

- spend money you have set aside for closing

- omit debts or liabilities from your loan application

- buy furniture

- originate any inquiries to your credit

- make a large cash deposit without checking with your loan officer

- change bank accounts

- co-sign a loan for anyone

{endAccordion}

{beginAccordion}

Underwriting & Preparing for Closing

{openTab}

Expenses to Expect

Before Closing

At Closing

- Closing Costs

- Escrow Origination

Home Appraisal - An analysis performed by a qualified individual to determine the estimated value of a home.

Earnest Money - A sum of cash paid to a seller by a buyer prior to closing to show that the buyer is serious about buying the house.

Home Inspection - A complete and detailed inspection that examines and evaluates the mechanical and structural condition of a property. A complete and satisfactory home inspection is often required by the homebuyer.

Homeowner's Insurance - Insurance that protects a homeowner against the cost of damages to property caused by fire, windstorms, and other common hazards. Also referred to as hazard insurance.

Closing Costs - The total of all items that must be paid at closing related to your new mortgage.

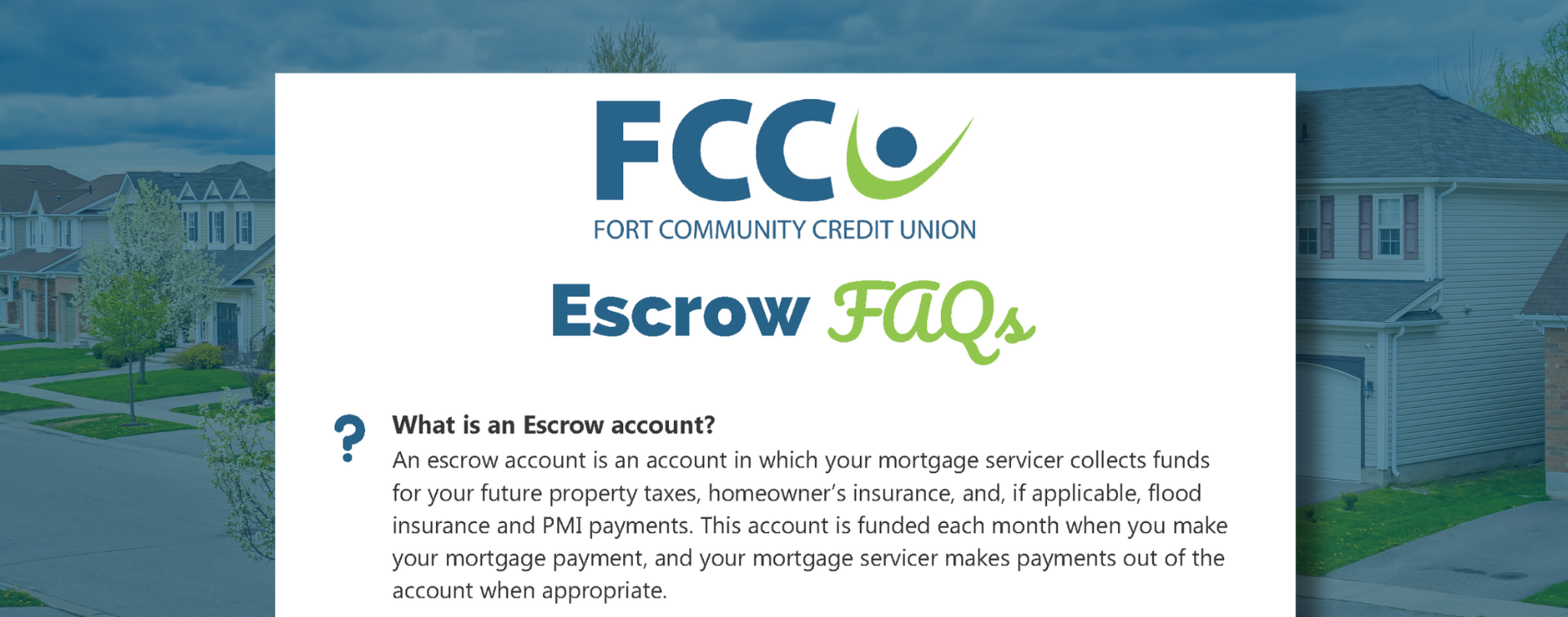

Escrow - Funds a mortgagor pays to the lender along with their monthly principal and interest payments for the payment of real estate taxes and hazard insurance. The money is held by the lender to make payments when they are due.

Down Payment Options

Less than 20% down

Private Mortgage Insurance (PMI) is required.

- HomeReady/ Home Possible - 3% Down

- Conventional Mortgage Loan - 5% Down

- VA Home Loan - 0% Down

- FHA Loan - Low Down Payment

20% or more down

No Private Mortgage Insurance (PMI) required.

Lower monthly payments.

20% down is required for our ITIN Mortgage Program.

Private Mortgage Insurance (PMI) - Insurance to protect the mortgage lender against losses that might be incurred if a loan defaults (usually required if the borrower puts less than 20% down).

{endAccordion}

{beginAccordion}

Down Payment Assistance Grant Programs

{openTab}

Down Payment Assistance (DPA) Program with The HOME Consortium

Up to $10,000 to be used for down payment and/or closing costs

- Forgives 20% of loan each full year

- Partial repayment may be required if property is sold, ceases to be primary residence, title is transferred, or cash out refinance

Eligibility Requirements

Ask a loan officer for the most up-to-date eligibility requirements.

- Buyer must reside in the home as primary residence for five years for the Forgivable Loan to be forgiven in full

- Buyer must complete approved home buyer counseling program (see list below)

- Home must in Jefferson, Ozaukee, Washington, or Waukesha County

- Home must be owner-occupied, single-family attached/detached units

- Selling price of home must be below purchase price limits set by HUD

- Buyers must have an annual household income at or below 80% of the area county median

- Total household debt-to-income ratio must be between 18-50%

- Home must pass the HOME Consortium inspection before closing (initial and final inspection)

- Buyers using an ITIN must sign Qualified Alien Submission Form

Downpayment Plus Program (DPP) with FHLBank Chicago

Up to $10,000 to be used for down payment and/or closing costs

- Forgives part of the loan each month

- Grants are given on a first-come, first-serve basisif funds are still available

Eligibility Requirements

Ask a loan officer for the most up-to-date eligibility requirements.

- Buyer must reside in the home as primary residence for five years for the Forgivable Loan to be forgiven in full

- Buyer must complete approved home buyer counseling program (see list below)

- Buyers must have $1,000 of their own money, which can go towards earnest money, down payment, home inspection, first year’s home insurance, or closing costs

- Buyers must have an annual household income at or below an amount specified by HUD

Home Buying Counseling Requirements

Both the DPA and DPP grant programs require home buyers to complete one-on-one counseling through an approved home buyer counseling organization prior to closing. A "Certificate of Achievement" must be included in the closed loan file.

Below is a listing of the home buyer counseling organizations and their contact information.

Housing Resources, Inc. (HRI)

Jaquetia Tate

217 Wisconsin Ave, Suite 411

Waukesha, WI 53186

(262) 522-1230

[email protected]

www.hri-wi.org

Jefferson County Economic Development Consortium

RoxAnne Witte

864 Collins Road, Suite 111

Jefferson, WI 53549

(920) 674-8711

[email protected]

http://www.jeffersoncountyhomebuyer.com/

LaCasa de Esperanza, Inc.

Crystal Monsivais

134 Wisconsin Avenue

Waukesha, WI 53186

(262) 899-6787

[email protected]

Movin’ Out, Inc.

Rebecca Wiese, Theo Yancey

902 Royster Oaks Dr, Suite 105

Madison, WI 53714

(608) 251-4446

[email protected]

https://www.movin-out.org/

Forgivable Loan - A loan with no repayment obligation if program requirements are met for a specified period of time.

{endAccordion}

{beginAccordion}

Closing & Moving In

{openTab}

Closing Checklist

Before Closing

- Be in touch with your realtor or contact an attorney if home is For Sale by Owner.

- One week prior to closing, purchase Homeowner's Insurance (and flood insurance if applicable).

- Arrange for a Home Inspection. Bring a notebook to your inspection. Although your inspector will provide you with a copy of their notes, it is always a good idea to write your own. They may give you tips on how to fix minor issues.

- Schedule a final walkthrough to determine that all agreed upon repairs and other contingencies have been done.

- Review all closing documents and your Purchase Agreement. Know what your closing costs will be.

- Don't make any large purchases such as a car, appliances, etc.

- Contact utility companies as applicable such as water/sewer, electric, gas, etc.

At Closing

- Have a cashier's check (not personal check) for all closing expenses.

- Bring a photo ID.

- Get the keys for your new home and any adjacent buildings on your new property.

Purchase Agreement - A written contract signed by the buyer and seller stating the terms and conditions under which a property will be sold.

{endAccordion}