Don’t let a wrecked vehicle wreck your finances.

{beginAccordion}

What is GAP?

{openTab}

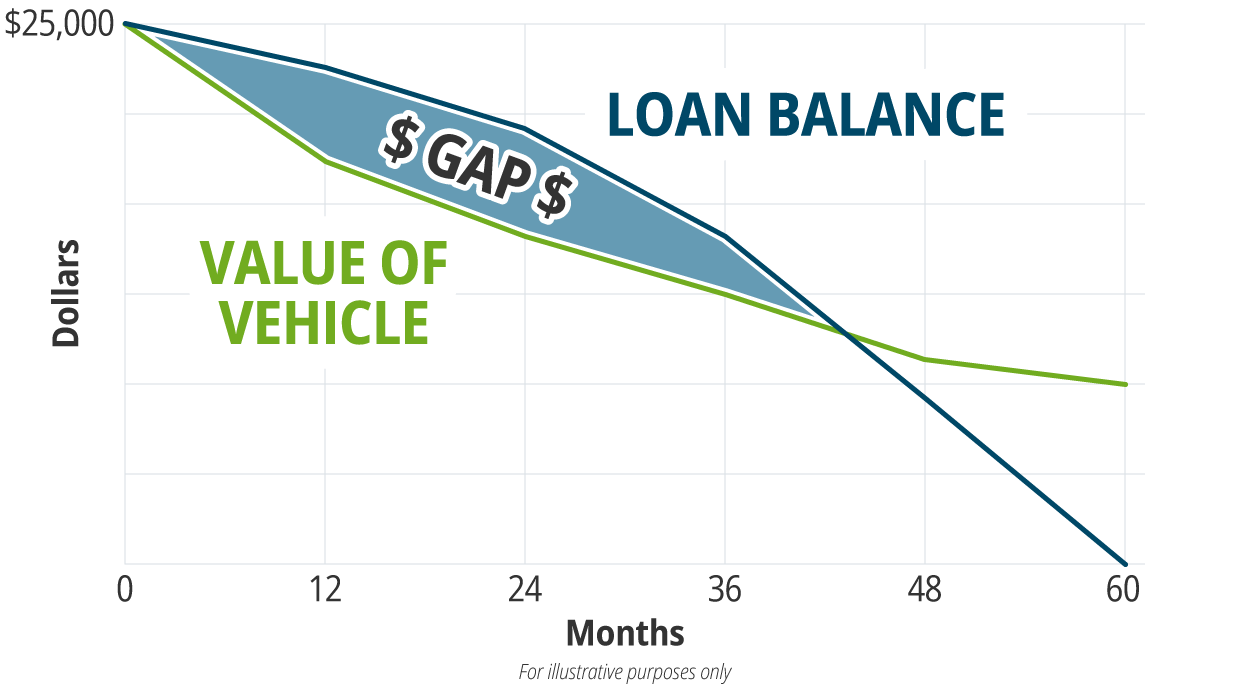

GAP (Guaranteed Asset Protection) - An optional product intended to cover the difference between the amount you owe on your vehicle loan and the amount your insurance company will pay if your vehicle is totaled ( CFPB, 2024).

Most insurance policies will only cover an amount up to the value of your vehicle, which drops the moment you drive off the lot. According to CARFAX, the value of your vehicle will typically drop more than 10% within the first month and continue to lose roughly 15% of its value per year after that.

This creates a gap between the value of your vehicle (according to your insurance) and your loan balance… which will need to be paid out-of-pocket if you don’t have GAP protection.

{endAccordion}

{beginAccordion}

GAP Plus with Deductible Assistance

{openTab}

GAP Plus with Deductible Assistance is like an airbag for your vehicle loan. Our GAP (Guaranteed Asset Protection) program can help cushion you and your family against sudden out-of-pocket expenses and goes beyond traditional GAP protection.

Core Benefits

GAP Protection

Reduce or eliminate the gap between what insurance will pay and your outstanding loan balance if your vehicle is deemed a total loss.

Reduce Cost of Next Vehicle

Get into your next vehicle by reducing your next loan at FCCU by $1,000.

Deductible Assistance

If your vehicle is damaged, but not deemed a total loss, and auto repairs cost more than your deductible, the deductible amount is applied to your loan, reducing what you owe.

|

Motor vehicle1 |

Power sport2 |

Water craft3 |

RV4 |

|

|

Maximum Benefit |

$50,000 |

$50,000 |

$50,000 |

$50,000 |

|

Maximum Loan/Lease-to-Value |

150% |

150% |

150% |

150% |

|

Maximum Loan/Lease term |

84 months |

84 months |

84 months |

84 months |

|

Maximum Loan/Lease Amount |

$100,000 |

$100,000 |

$50,000 |

$125,000 |

[1] Motor vehicle: Private passenger cars, vans, and light trucks less than 10,000 gross vehicle weight (GVW) for commercial or personal use.

[2] Powersport: Motorcycle, ATV, snowmobile, or personal watercraft for personal use.

[3] Watercraft: For personal use.

[4] RV: For personal use.

{endAccordion}

{beginAccordion}

Submit a Claim

{openTab}

Our team of consumer loan officers are ready to help you navigate the claims process and get the most out of your GAP protection.

To start the claims process, email our consumer loan team, call (920) 563-7305, or stop by one of our branch locations.

{endAccordion}

Your purchase of MEMBER’S CHOICE™ Guaranteed Asset Protection (GAP) is optional and will not affect your application for credit or the terms of any credit agreement you have with us. Certain eligibility requirements, conditions, and exclusions may apply. You will receive the contract before you are required to pay for GAP. You should carefully read the contract for a full explanation of the terms. If you choose GAP, adding the GAP fee to your loan amount will increase the cost of GAP. You may cancel GAP at any time. If you cancel GAP within 90 days you will receive a full refund of any fee paid.

GAP purchased from state-chartered credit unions in FL, GA, IA, RI, UT, VT, and WI, may be with or without a refund provision. Prices of the refundable and non-refundable products are likely to differ. If you choose a refundable product, you may cancel at any time during the loan and receive a refund of the unearned fee.

GAP purchased from state-chartered credit unions in CO, MO, or SC may be canceled at any time during the loan and receive a refund of the unearned fee.

GAP purchased from state-chartered credit unions in IN may be with or without a refund provision. If the credit union offers a refund provision, you may cancel at any time during the loan and receive a refund of the unearned fee.

GAP-2453288.1-0319-0421 © CUNA Mutual Group, 2019. All Rights Reserved.